BLOG DETAILS

BLOG DETAILS

BLOG DETAILS

Public vs. Private Infrastructure Projects: Understanding the Core Differences

Public vs. Private Infrastructure Projects: Understanding the Core Differences

Public vs. Private Infrastructure Projects: Understanding the Core Differences

Jul 31, 2025

/

Savik Infra

/

8 mins

Jul 31, 2025

/

Savik Infra

/

8 mins

Jul 31, 2025

/

Savik Infra

/

8 mins

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed. At the heart of this conversation are two powerful models: Public Infrastructure Projects and Private Infrastructure Projects, with an increasingly common hybrid—the Public-Private Partnership (PPP) model.

While each model plays a vital role in building the country’s roads, bridges, tunnels, and smart cities, the differences in structure, objectives, and execution can significantly impact outcomes.

Here’s a deeper look into how public and private infrastructure projects differ—and why both are essential to India’s growth.

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed. At the heart of this conversation are two powerful models: Public Infrastructure Projects and Private Infrastructure Projects, with an increasingly common hybrid—the Public-Private Partnership (PPP) model.

While each model plays a vital role in building the country’s roads, bridges, tunnels, and smart cities, the differences in structure, objectives, and execution can significantly impact outcomes.

Here’s a deeper look into how public and private infrastructure projects differ—and why both are essential to India’s growth.

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed. At the heart of this conversation are two powerful models: Public Infrastructure Projects and Private Infrastructure Projects, with an increasingly common hybrid—the Public-Private Partnership (PPP) model.

While each model plays a vital role in building the country’s roads, bridges, tunnels, and smart cities, the differences in structure, objectives, and execution can significantly impact outcomes.

Here’s a deeper look into how public and private infrastructure projects differ—and why both are essential to India’s growth.

Building home, happy hearts

Building home, happy hearts

Innovative technology with building better development

Innovative technology with building better development

Discovering possibility and transparent communication

Discovering possibility and transparent communication

The ability to turnaround costing with sustainable construction

The ability to turnaround costing with sustainable construction

Building home, happy hearts

Innovative technology with building better development

Discovering possibility and transparent communication

The ability to turnaround costing with sustainable construction

Building home, happy hearts

Innovative technology with building better development

Discovering possibility and transparent communication

The ability to turnaround costing with sustainable construction

🔹 1. Ownership, Funding & Control

Public Infrastructure Projects are fully owned and financed by government bodies—be it central, state, or municipal. The funding typically comes from public taxes, government budgets, or international aid/grants. The objective here is service to citizens, not profit.

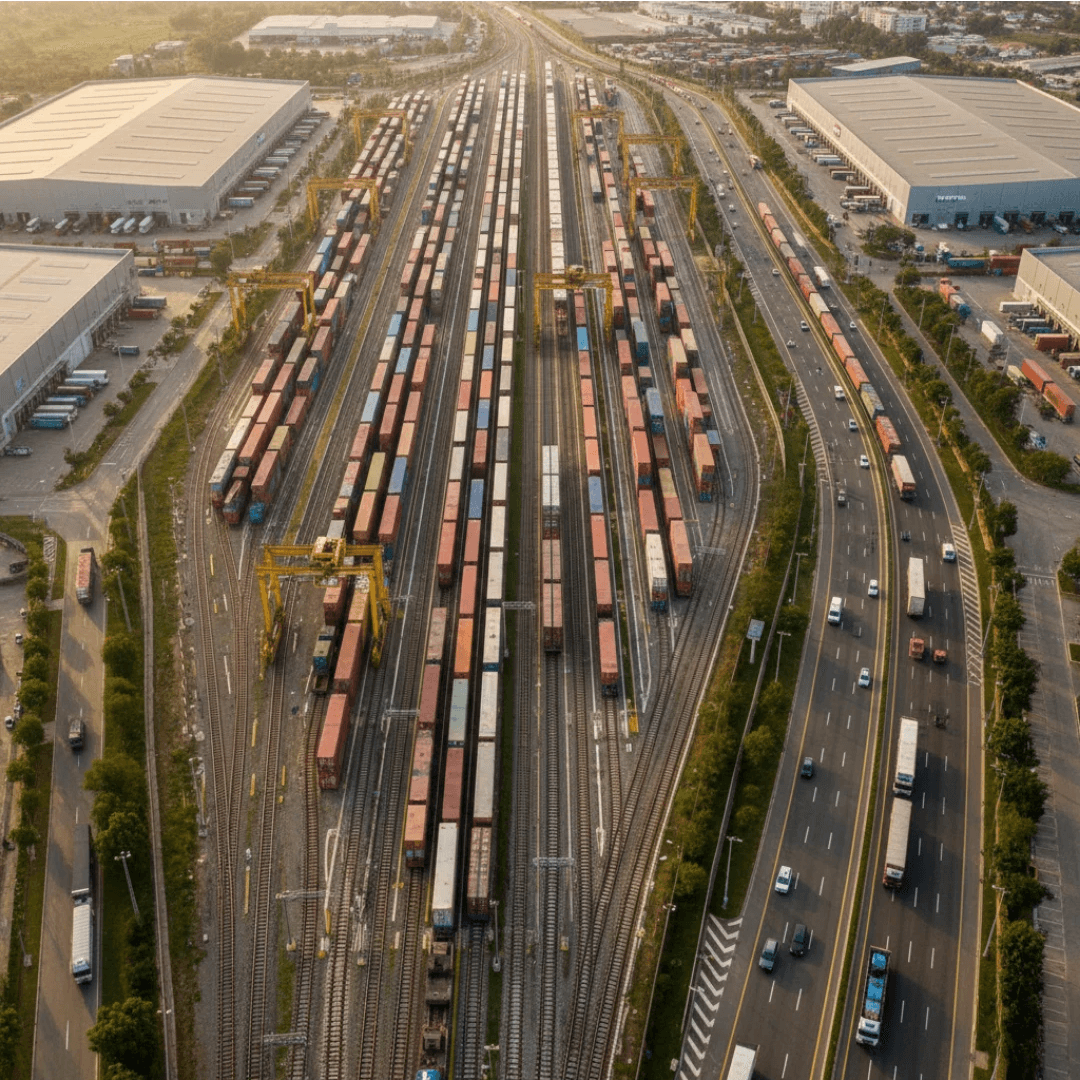

Private Infrastructure Projects, on the other hand, are owned and financed by private companies or investors. These are typically undertaken in commercially viable sectors such as logistics hubs, toll roads, airports, industrial parks, or real estate infrastructure. Revenue generation is central to the model—through user fees, rentals, or direct returns on investment.

Example: A city flyover managed by the BMC is a public asset; a private toll bridge developed by a corporate consortium is a private infrastructure venture.

🔹 2. Purpose and Outcome Orientation

Public Projects are guided by long-term socio-economic impact. The returns are measured in terms of public utility—better transportation, reduced congestion, and improved living standards.

Private Projects are designed for high efficiency and quick monetization. While they may serve public needs, the decision-making is ROI-driven. The metrics of success here are revenue, usage volume, and maintenance costs.

Insight: This is why public projects are often located in underdeveloped areas where private investors may hesitate to venture due to low immediate returns.

🔹 3. Execution Timeline & Efficiency

Public Sector Projects often involve multiple layers of planning, approvals, and coordination across departments. This can lead to delays—but also ensures broader compliance, public accountability, and stakeholder engagement.

Private Projects benefit from streamlined decision-making, fewer procedural delays, and tighter project management. Many large infrastructure firms maintain in-house teams for planning, compliance, and execution—allowing them to move faster.

Reality Check: Public projects like highways or sewer lines may take years to clear land and environmental approvals, while private parks or tech parks are often built in 18–24 months.

🔹 4. Risk Distribution

In pure public projects, the government bears almost all the risks—be it financial, environmental, or political.

In private projects, the private entity absorbs most of the risk, which is why feasibility studies, return models, and long-term operation strategies are critical before project kick-off.

In PPP models, risk is shared. The government may offer land or subsidies, while the private player handles construction and operation.

PPP Examples in India: Yamuna Expressway, Hyderabad Metro, Eastern Freeway – all built under risk-sharing models where each party brings its strengths.

🔹 5. Transparency and Accountability

Public projects are held accountable through audits, public reports, and democratic oversight. Every delay or budget overrun is a matter of public record.

Private projects are more flexible but also less transparent. Decision-making happens behind closed doors, and data is usually proprietary unless mandated by regulators.

Observation: This doesn’t mean one is better—it just means that public projects must prioritize public perception and political context alongside execution.

🔹 1. Ownership, Funding & Control

Public Infrastructure Projects are fully owned and financed by government bodies—be it central, state, or municipal. The funding typically comes from public taxes, government budgets, or international aid/grants. The objective here is service to citizens, not profit.

Private Infrastructure Projects, on the other hand, are owned and financed by private companies or investors. These are typically undertaken in commercially viable sectors such as logistics hubs, toll roads, airports, industrial parks, or real estate infrastructure. Revenue generation is central to the model—through user fees, rentals, or direct returns on investment.

Example: A city flyover managed by the BMC is a public asset; a private toll bridge developed by a corporate consortium is a private infrastructure venture.

🔹 2. Purpose and Outcome Orientation

Public Projects are guided by long-term socio-economic impact. The returns are measured in terms of public utility—better transportation, reduced congestion, and improved living standards.

Private Projects are designed for high efficiency and quick monetization. While they may serve public needs, the decision-making is ROI-driven. The metrics of success here are revenue, usage volume, and maintenance costs.

Insight: This is why public projects are often located in underdeveloped areas where private investors may hesitate to venture due to low immediate returns.

🔹 3. Execution Timeline & Efficiency

Public Sector Projects often involve multiple layers of planning, approvals, and coordination across departments. This can lead to delays—but also ensures broader compliance, public accountability, and stakeholder engagement.

Private Projects benefit from streamlined decision-making, fewer procedural delays, and tighter project management. Many large infrastructure firms maintain in-house teams for planning, compliance, and execution—allowing them to move faster.

Reality Check: Public projects like highways or sewer lines may take years to clear land and environmental approvals, while private parks or tech parks are often built in 18–24 months.

🔹 4. Risk Distribution

In pure public projects, the government bears almost all the risks—be it financial, environmental, or political.

In private projects, the private entity absorbs most of the risk, which is why feasibility studies, return models, and long-term operation strategies are critical before project kick-off.

In PPP models, risk is shared. The government may offer land or subsidies, while the private player handles construction and operation.

PPP Examples in India: Yamuna Expressway, Hyderabad Metro, Eastern Freeway – all built under risk-sharing models where each party brings its strengths.

🔹 5. Transparency and Accountability

Public projects are held accountable through audits, public reports, and democratic oversight. Every delay or budget overrun is a matter of public record.

Private projects are more flexible but also less transparent. Decision-making happens behind closed doors, and data is usually proprietary unless mandated by regulators.

Observation: This doesn’t mean one is better—it just means that public projects must prioritize public perception and political context alongside execution.

🔹 1. Ownership, Funding & Control

Public Infrastructure Projects are fully owned and financed by government bodies—be it central, state, or municipal. The funding typically comes from public taxes, government budgets, or international aid/grants. The objective here is service to citizens, not profit.

Private Infrastructure Projects, on the other hand, are owned and financed by private companies or investors. These are typically undertaken in commercially viable sectors such as logistics hubs, toll roads, airports, industrial parks, or real estate infrastructure. Revenue generation is central to the model—through user fees, rentals, or direct returns on investment.

Example: A city flyover managed by the BMC is a public asset; a private toll bridge developed by a corporate consortium is a private infrastructure venture.

🔹 2. Purpose and Outcome Orientation

Public Projects are guided by long-term socio-economic impact. The returns are measured in terms of public utility—better transportation, reduced congestion, and improved living standards.

Private Projects are designed for high efficiency and quick monetization. While they may serve public needs, the decision-making is ROI-driven. The metrics of success here are revenue, usage volume, and maintenance costs.

Insight: This is why public projects are often located in underdeveloped areas where private investors may hesitate to venture due to low immediate returns.

🔹 3. Execution Timeline & Efficiency

Public Sector Projects often involve multiple layers of planning, approvals, and coordination across departments. This can lead to delays—but also ensures broader compliance, public accountability, and stakeholder engagement.

Private Projects benefit from streamlined decision-making, fewer procedural delays, and tighter project management. Many large infrastructure firms maintain in-house teams for planning, compliance, and execution—allowing them to move faster.

Reality Check: Public projects like highways or sewer lines may take years to clear land and environmental approvals, while private parks or tech parks are often built in 18–24 months.

🔹 4. Risk Distribution

In pure public projects, the government bears almost all the risks—be it financial, environmental, or political.

In private projects, the private entity absorbs most of the risk, which is why feasibility studies, return models, and long-term operation strategies are critical before project kick-off.

In PPP models, risk is shared. The government may offer land or subsidies, while the private player handles construction and operation.

PPP Examples in India: Yamuna Expressway, Hyderabad Metro, Eastern Freeway – all built under risk-sharing models where each party brings its strengths.

🔹 5. Transparency and Accountability

Public projects are held accountable through audits, public reports, and democratic oversight. Every delay or budget overrun is a matter of public record.

Private projects are more flexible but also less transparent. Decision-making happens behind closed doors, and data is usually proprietary unless mandated by regulators.

Observation: This doesn’t mean one is better—it just means that public projects must prioritize public perception and political context alongside execution.

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed.

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed.

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed.

As India moves forward with its ambitious infrastructure goals, the question isn’t whether we need more development—it’s how that development is funded, planned, and executed.

🔹 Conclusion: Why Both Models Matter

India’s infrastructure needs are vast and complex. No single model can meet the scale of demand on its own.

Public projects are essential for equitable development—reaching remote areas, building essential services, and fostering inclusive growth.

Private and PPP projects introduce innovation, speed, and funding diversification—especially in high-demand urban areas where scalability is key.

At Savik Infra, we’ve been at the forefront of public infrastructure development for over 30 years. Our legacy spans flyovers, highways, and major municipal contracts with institutions like the BMC—delivered with the highest standards of quality, safety, and sustainability.

As India’s infrastructure story enters a new era, Savik Infra stands ready to partner across models—public, private, and everything in between—to build a stronger, more connected tomorrow.

🔹 Conclusion: Why Both Models Matter

India’s infrastructure needs are vast and complex. No single model can meet the scale of demand on its own.

Public projects are essential for equitable development—reaching remote areas, building essential services, and fostering inclusive growth.

Private and PPP projects introduce innovation, speed, and funding diversification—especially in high-demand urban areas where scalability is key.

At Savik Infra, we’ve been at the forefront of public infrastructure development for over 30 years. Our legacy spans flyovers, highways, and major municipal contracts with institutions like the BMC—delivered with the highest standards of quality, safety, and sustainability.

As India’s infrastructure story enters a new era, Savik Infra stands ready to partner across models—public, private, and everything in between—to build a stronger, more connected tomorrow.

🔹 Conclusion: Why Both Models Matter

India’s infrastructure needs are vast and complex. No single model can meet the scale of demand on its own.

Public projects are essential for equitable development—reaching remote areas, building essential services, and fostering inclusive growth.

Private and PPP projects introduce innovation, speed, and funding diversification—especially in high-demand urban areas where scalability is key.

At Savik Infra, we’ve been at the forefront of public infrastructure development for over 30 years. Our legacy spans flyovers, highways, and major municipal contracts with institutions like the BMC—delivered with the highest standards of quality, safety, and sustainability.

As India’s infrastructure story enters a new era, Savik Infra stands ready to partner across models—public, private, and everything in between—to build a stronger, more connected tomorrow.

OUR LATEST NEWS

OUR LATEST NEWS

OUR LATEST NEWS