BLOG DETAILS

BLOG DETAILS

BLOG DETAILS

Freight, Finance & Future Planning: Economic Indicators Every Infrastructure Developer Should Watch

Freight, Finance & Future Planning: Economic Indicators Every Infrastructure Developer Should Watch

Freight, Finance & Future Planning: Economic Indicators Every Infrastructure Developer Should Watch

Feb 2, 2026

/

savik infra

/

8 min

Feb 2, 2026

/

savik infra

/

8 min

Feb 2, 2026

/

savik infra

/

8 min

Introduction: Why Economic Intelligence Matters in Infrastructure Development

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence. For infrastructure developers operating in sectors such as rail, logistics, ports, and industrial connectivity, understanding macroeconomic trends is essential for sustainable growth.

Freight movement, financial conditions, policy reforms, and industrial output directly influence project viability and long-term returns. Organizations working closely with freight ecosystems, including Indian Railways, must align their infrastructure strategies with economic signals that shape cargo demand and capital availability.

In today’s competitive environment, monitoring the right economic indicators for infrastructure development can determine whether a project thrives or struggles.

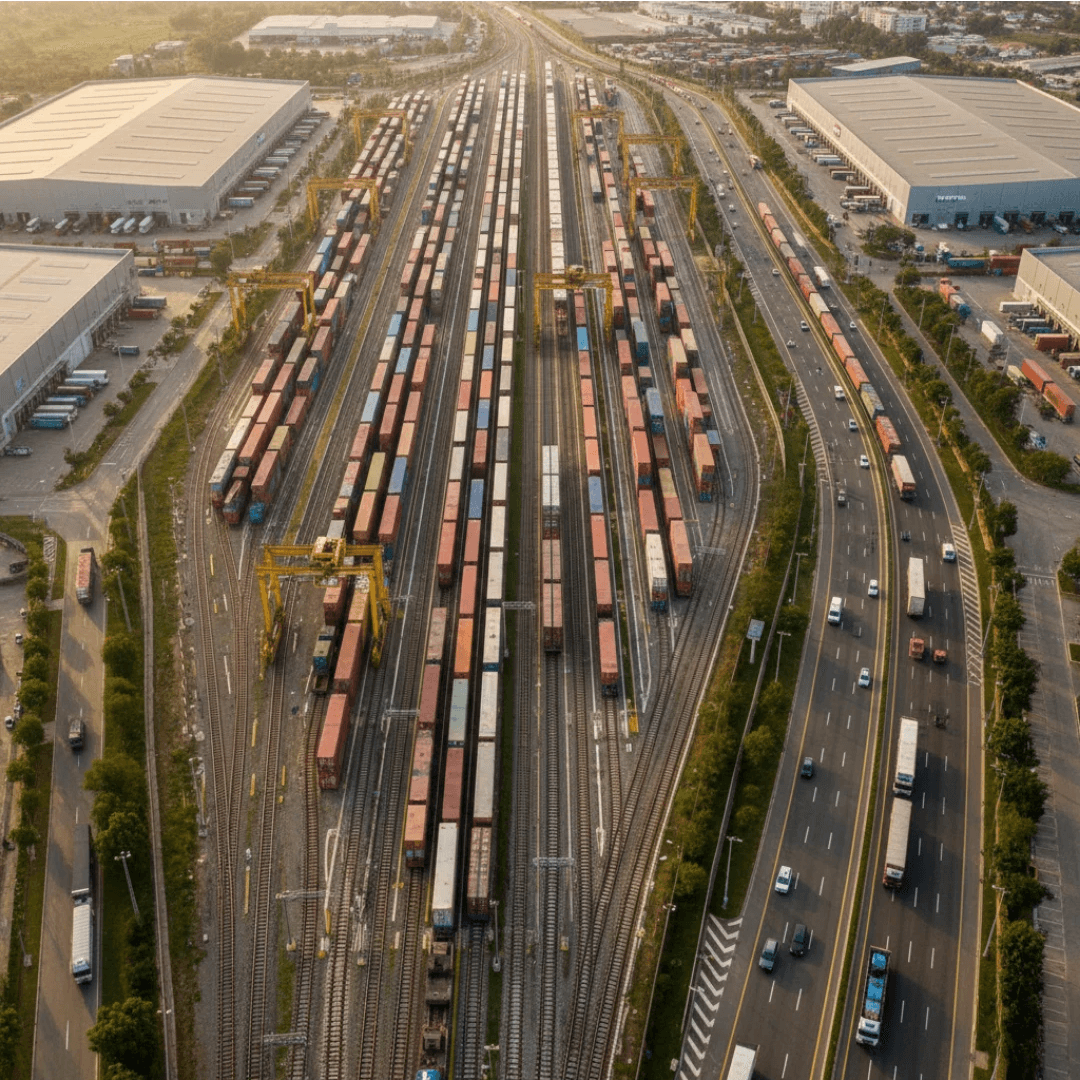

Freight Movement Trends: The Pulse of Industrial Growth

Freight volume is one of the most critical indicators for infrastructure developers. Rising rail freight traffic often signals industrial expansion, increased manufacturing output, and stronger commodity demand.

With expansion initiatives led by the Dedicated Freight Corridor Corporation of India Limited, India’s freight capacity is increasing significantly. Higher freight throughput reflects demand for railway siding projects, logistics parks, container terminals, and warehousing infrastructure.

Tracking freight trends across commodities—coal, cement, steel, fertilizers, and containerized cargo—provides valuable insight into where infrastructure investment should be directed. Developers who anticipate freight growth can strategically position projects near high-demand corridors and industrial clusters.

Introduction: Why Economic Intelligence Matters in Infrastructure Development

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence. For infrastructure developers operating in sectors such as rail, logistics, ports, and industrial connectivity, understanding macroeconomic trends is essential for sustainable growth.

Freight movement, financial conditions, policy reforms, and industrial output directly influence project viability and long-term returns. Organizations working closely with freight ecosystems, including Indian Railways, must align their infrastructure strategies with economic signals that shape cargo demand and capital availability.

In today’s competitive environment, monitoring the right economic indicators for infrastructure development can determine whether a project thrives or struggles.

Freight Movement Trends: The Pulse of Industrial Growth

Freight volume is one of the most critical indicators for infrastructure developers. Rising rail freight traffic often signals industrial expansion, increased manufacturing output, and stronger commodity demand.

With expansion initiatives led by the Dedicated Freight Corridor Corporation of India Limited, India’s freight capacity is increasing significantly. Higher freight throughput reflects demand for railway siding projects, logistics parks, container terminals, and warehousing infrastructure.

Tracking freight trends across commodities—coal, cement, steel, fertilizers, and containerized cargo—provides valuable insight into where infrastructure investment should be directed. Developers who anticipate freight growth can strategically position projects near high-demand corridors and industrial clusters.

Introduction: Why Economic Intelligence Matters in Infrastructure Development

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence. For infrastructure developers operating in sectors such as rail, logistics, ports, and industrial connectivity, understanding macroeconomic trends is essential for sustainable growth.

Freight movement, financial conditions, policy reforms, and industrial output directly influence project viability and long-term returns. Organizations working closely with freight ecosystems, including Indian Railways, must align their infrastructure strategies with economic signals that shape cargo demand and capital availability.

In today’s competitive environment, monitoring the right economic indicators for infrastructure development can determine whether a project thrives or struggles.

Freight Movement Trends: The Pulse of Industrial Growth

Freight volume is one of the most critical indicators for infrastructure developers. Rising rail freight traffic often signals industrial expansion, increased manufacturing output, and stronger commodity demand.

With expansion initiatives led by the Dedicated Freight Corridor Corporation of India Limited, India’s freight capacity is increasing significantly. Higher freight throughput reflects demand for railway siding projects, logistics parks, container terminals, and warehousing infrastructure.

Tracking freight trends across commodities—coal, cement, steel, fertilizers, and containerized cargo—provides valuable insight into where infrastructure investment should be directed. Developers who anticipate freight growth can strategically position projects near high-demand corridors and industrial clusters.

Building home, happy hearts

Building home, happy hearts

Innovative technology with building better development

Innovative technology with building better development

Discovering possibility and transparent communication

Discovering possibility and transparent communication

The ability to turnaround costing with sustainable construction

The ability to turnaround costing with sustainable construction

Building home, happy hearts

Innovative technology with building better development

Discovering possibility and transparent communication

The ability to turnaround costing with sustainable construction

Building home, happy hearts

Innovative technology with building better development

Discovering possibility and transparent communication

The ability to turnaround costing with sustainable construction

GDP Growth & Industrial Production Index (IIP)

Economic growth indicators such as GDP expansion and the Industrial Production Index (IIP) serve as leading signals for infrastructure demand. When manufacturing output rises, the need for logistics infrastructure—rail connectivity, freight terminals, and multimodal transport hubs—naturally increases.

A strong industrial output cycle often leads to higher demand for rail freight infrastructure, EPC projects, and integrated logistics solutions. Conversely, slowdowns may signal the need for cautious capital allocation and phased project execution.

For infrastructure companies, aligning expansion strategies with macroeconomic cycles ensures financial stability and sustainable scaling.

Capital Expenditure & Government Infrastructure Spending

Public capital expenditure plays a decisive role in shaping infrastructure opportunities. Government investments in rail modernization, port expansion, highway development, and freight corridors create a multiplier effect for private infrastructure developers.

Policies supporting rail electrification, industrial corridors, and multimodal logistics parks are directly linked to opportunities in railway siding development and freight infrastructure integration. Collaboration with agencies like Indian Railways often depends on understanding budget allocations and long-term infrastructure plans.

Developers who track infrastructure spending trends can proactively prepare bids, partnerships, and technical capabilities aligned with national priorities.

Interest Rates, Credit Availability & Financial Health

Infrastructure projects are capital-intensive and highly sensitive to financing conditions. Interest rates, credit availability, and banking sector liquidity directly affect project feasibility and return on investment.

When borrowing costs are low and financial institutions actively fund infrastructure, project development accelerates. Conversely, tighter credit conditions may slow project execution or require innovative financing models such as public-private partnerships (PPP).

Monitoring financial indicators ensures developers maintain balanced debt structures, optimized funding strategies, and long-term financial sustainability.

GDP Growth & Industrial Production Index (IIP)

Economic growth indicators such as GDP expansion and the Industrial Production Index (IIP) serve as leading signals for infrastructure demand. When manufacturing output rises, the need for logistics infrastructure—rail connectivity, freight terminals, and multimodal transport hubs—naturally increases.

A strong industrial output cycle often leads to higher demand for rail freight infrastructure, EPC projects, and integrated logistics solutions. Conversely, slowdowns may signal the need for cautious capital allocation and phased project execution.

For infrastructure companies, aligning expansion strategies with macroeconomic cycles ensures financial stability and sustainable scaling.

Capital Expenditure & Government Infrastructure Spending

Public capital expenditure plays a decisive role in shaping infrastructure opportunities. Government investments in rail modernization, port expansion, highway development, and freight corridors create a multiplier effect for private infrastructure developers.

Policies supporting rail electrification, industrial corridors, and multimodal logistics parks are directly linked to opportunities in railway siding development and freight infrastructure integration. Collaboration with agencies like Indian Railways often depends on understanding budget allocations and long-term infrastructure plans.

Developers who track infrastructure spending trends can proactively prepare bids, partnerships, and technical capabilities aligned with national priorities.

Interest Rates, Credit Availability & Financial Health

Infrastructure projects are capital-intensive and highly sensitive to financing conditions. Interest rates, credit availability, and banking sector liquidity directly affect project feasibility and return on investment.

When borrowing costs are low and financial institutions actively fund infrastructure, project development accelerates. Conversely, tighter credit conditions may slow project execution or require innovative financing models such as public-private partnerships (PPP).

Monitoring financial indicators ensures developers maintain balanced debt structures, optimized funding strategies, and long-term financial sustainability.

GDP Growth & Industrial Production Index (IIP)

Economic growth indicators such as GDP expansion and the Industrial Production Index (IIP) serve as leading signals for infrastructure demand. When manufacturing output rises, the need for logistics infrastructure—rail connectivity, freight terminals, and multimodal transport hubs—naturally increases.

A strong industrial output cycle often leads to higher demand for rail freight infrastructure, EPC projects, and integrated logistics solutions. Conversely, slowdowns may signal the need for cautious capital allocation and phased project execution.

For infrastructure companies, aligning expansion strategies with macroeconomic cycles ensures financial stability and sustainable scaling.

Capital Expenditure & Government Infrastructure Spending

Public capital expenditure plays a decisive role in shaping infrastructure opportunities. Government investments in rail modernization, port expansion, highway development, and freight corridors create a multiplier effect for private infrastructure developers.

Policies supporting rail electrification, industrial corridors, and multimodal logistics parks are directly linked to opportunities in railway siding development and freight infrastructure integration. Collaboration with agencies like Indian Railways often depends on understanding budget allocations and long-term infrastructure plans.

Developers who track infrastructure spending trends can proactively prepare bids, partnerships, and technical capabilities aligned with national priorities.

Interest Rates, Credit Availability & Financial Health

Infrastructure projects are capital-intensive and highly sensitive to financing conditions. Interest rates, credit availability, and banking sector liquidity directly affect project feasibility and return on investment.

When borrowing costs are low and financial institutions actively fund infrastructure, project development accelerates. Conversely, tighter credit conditions may slow project execution or require innovative financing models such as public-private partnerships (PPP).

Monitoring financial indicators ensures developers maintain balanced debt structures, optimized funding strategies, and long-term financial sustainability.

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence

Infrastructure development is no longer driven by construction capability alone—it is guided by economic intelligence

Export-Import Trends & Trade Performance

India’s export performance is closely linked to logistics infrastructure demand. Growth in container traffic, port handling capacity, and cross-border trade directly influences the need for rail-port connectivity and integrated freight systems.

As India strengthens its global trade footprint, efficient freight corridors and smart logistics integration become essential. Infrastructure developers must monitor trade data, port volumes, and container traffic trends to identify emerging investment zones.

Improved trade performance typically leads to expansion of industrial clusters, warehousing zones, and rail-linked freight terminals—creating strong growth opportunities in industrial infrastructure development.

Inflation & Commodity Prices

Commodity prices and inflation levels impact construction costs, material procurement, and project budgets. Fluctuations in steel, cement, fuel, and other raw materials can significantly influence infrastructure project viability.

By closely tracking commodity markets, developers can optimize procurement strategies and protect project margins. Proactive financial planning ensures resilience against cost volatility and economic uncertainty.

Future Planning: Data-Driven Infrastructure Strategy

Successful infrastructure developers integrate economic data into long-term strategic planning. Freight projections, financial conditions, government spending patterns, and industrial growth forecasts collectively shape investment decisions.

Data-driven planning enables better risk management, optimal resource allocation, and strategic expansion into high-growth corridors. As India continues modernizing its logistics ecosystem, developers who combine engineering expertise with economic foresight will lead the transformation.

Future-ready infrastructure is not built on concrete alone—it is built on informed decisions backed by economic intelligence.

Conclusion

Freight trends, financial indicators, and macroeconomic signals are critical tools for infrastructure developers navigating India’s evolving industrial landscape. Monitoring freight volumes, GDP growth, capital expenditure, interest rates, and trade performance enables smarter decision-making and sustainable expansion.

As India strengthens its rail networks, freight corridors, and multimodal logistics infrastructure, developers who align projects with economic indicators will remain competitive and resilient. Strategic planning, financial discipline, and infrastructure excellence together define the future of industrial growth.

For forward-thinking organizations, economic awareness is not optional—it is the foundation of long-term infrastructure success.

Export-Import Trends & Trade Performance

India’s export performance is closely linked to logistics infrastructure demand. Growth in container traffic, port handling capacity, and cross-border trade directly influences the need for rail-port connectivity and integrated freight systems.

As India strengthens its global trade footprint, efficient freight corridors and smart logistics integration become essential. Infrastructure developers must monitor trade data, port volumes, and container traffic trends to identify emerging investment zones.

Improved trade performance typically leads to expansion of industrial clusters, warehousing zones, and rail-linked freight terminals—creating strong growth opportunities in industrial infrastructure development.

Inflation & Commodity Prices

Commodity prices and inflation levels impact construction costs, material procurement, and project budgets. Fluctuations in steel, cement, fuel, and other raw materials can significantly influence infrastructure project viability.

By closely tracking commodity markets, developers can optimize procurement strategies and protect project margins. Proactive financial planning ensures resilience against cost volatility and economic uncertainty.

Future Planning: Data-Driven Infrastructure Strategy

Successful infrastructure developers integrate economic data into long-term strategic planning. Freight projections, financial conditions, government spending patterns, and industrial growth forecasts collectively shape investment decisions.

Data-driven planning enables better risk management, optimal resource allocation, and strategic expansion into high-growth corridors. As India continues modernizing its logistics ecosystem, developers who combine engineering expertise with economic foresight will lead the transformation.

Future-ready infrastructure is not built on concrete alone—it is built on informed decisions backed by economic intelligence.

Conclusion

Freight trends, financial indicators, and macroeconomic signals are critical tools for infrastructure developers navigating India’s evolving industrial landscape. Monitoring freight volumes, GDP growth, capital expenditure, interest rates, and trade performance enables smarter decision-making and sustainable expansion.

As India strengthens its rail networks, freight corridors, and multimodal logistics infrastructure, developers who align projects with economic indicators will remain competitive and resilient. Strategic planning, financial discipline, and infrastructure excellence together define the future of industrial growth.

For forward-thinking organizations, economic awareness is not optional—it is the foundation of long-term infrastructure success.

Export-Import Trends & Trade Performance

India’s export performance is closely linked to logistics infrastructure demand. Growth in container traffic, port handling capacity, and cross-border trade directly influences the need for rail-port connectivity and integrated freight systems.

As India strengthens its global trade footprint, efficient freight corridors and smart logistics integration become essential. Infrastructure developers must monitor trade data, port volumes, and container traffic trends to identify emerging investment zones.

Improved trade performance typically leads to expansion of industrial clusters, warehousing zones, and rail-linked freight terminals—creating strong growth opportunities in industrial infrastructure development.

Inflation & Commodity Prices

Commodity prices and inflation levels impact construction costs, material procurement, and project budgets. Fluctuations in steel, cement, fuel, and other raw materials can significantly influence infrastructure project viability.

By closely tracking commodity markets, developers can optimize procurement strategies and protect project margins. Proactive financial planning ensures resilience against cost volatility and economic uncertainty.

Future Planning: Data-Driven Infrastructure Strategy

Successful infrastructure developers integrate economic data into long-term strategic planning. Freight projections, financial conditions, government spending patterns, and industrial growth forecasts collectively shape investment decisions.

Data-driven planning enables better risk management, optimal resource allocation, and strategic expansion into high-growth corridors. As India continues modernizing its logistics ecosystem, developers who combine engineering expertise with economic foresight will lead the transformation.

Future-ready infrastructure is not built on concrete alone—it is built on informed decisions backed by economic intelligence.

Conclusion

Freight trends, financial indicators, and macroeconomic signals are critical tools for infrastructure developers navigating India’s evolving industrial landscape. Monitoring freight volumes, GDP growth, capital expenditure, interest rates, and trade performance enables smarter decision-making and sustainable expansion.

As India strengthens its rail networks, freight corridors, and multimodal logistics infrastructure, developers who align projects with economic indicators will remain competitive and resilient. Strategic planning, financial discipline, and infrastructure excellence together define the future of industrial growth.

For forward-thinking organizations, economic awareness is not optional—it is the foundation of long-term infrastructure success.

OUR LATEST NEWS

OUR LATEST NEWS

OUR LATEST NEWS